Both Sui and Solana are built for speed, scalability, and low-cost transactions — yet they approach the problem in very different ways. While Solana has already made its mark as a fast Layer-1 chain, Sui is a newer player built around parallel execution and smart object-based architecture. Let’s see how they stack up.

| Parameter | Sui (SUI) | Solana (SOL) |

|---|---|---|

| Consensus Mechanism | Narwhal–Bullshark (DAG + PoS) | Proof-of-History + PoS |

| Transactions per Second (TPS) | ~297,000 theoretical | ~65,000 theoretical / 2,600–4,000 practical |

| Transaction Fees | ~$0.0005 | ~$0.00025 |

| Smart Contract Language | Move | Rust, C, C++ |

| Decentralization | Moderate (~100 validators) | Moderate (~1,000 validators) |

| Ecosystem Size | Growing rapidly | Mature and established |

| Security | Strong (object-based model) | Moderate (occasional outages) |

| Energy Consumption | Very low (PoS) | Low (PoH + PoS) |

| Scalability | Horizontally scalable (parallel txns) | Vertical scaling on Layer 1 |

| Market Cap (Oct 2025) | ~$6–8B | ~$10–15B |

| Circulating Supply | ~2.5B SUI | ~580M SOL |

| NFT & DeFi Support | Expanding (BlueMove, Cetus) | Strong (Magic Eden, Jupiter) |

| Tokenomics | Inflationary, staking rewards | Inflationary, small burn |

| Network Reliability | Very stable so far | Occasional outages |

| Future Upgrades | Enhanced parallelization, zk tech | Validator expansion, stability |

| Best Use Case | Gaming, instant transactions | DeFi, NFTs, large user base |

Detailed Comparison

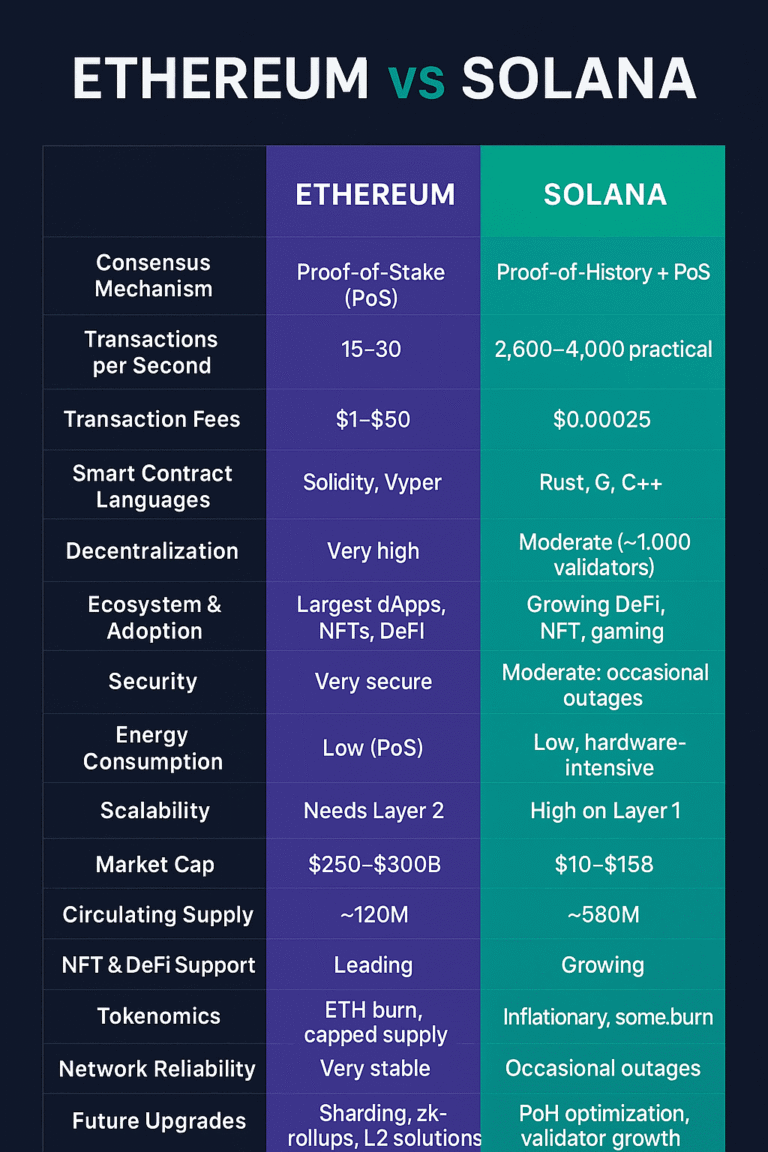

1. Consensus Mechanism

Sui Uses Narwhal–Bullshark, a DAG-based consensus layered over PoS, separating transaction ordering and consensus for faster processing.

Solana In contrast, uses Proof-of-History alongside PoS, timestamping transactions to achieve near-instant ordering.

2. Transaction Speed

Sui Can theoretically process ~297,000 TPS, thanks to parallel execution.

Solana Handles up to 65,000 TPS but averages 2,600–4,000 under real-world loads.

Both are far faster than Ethereum but differ in architecture.

3. Transaction Fees

Both are extremely cheap — less than a cent per transaction. Sui’s fees are slightly higher on average but still negligible.

4. Smart Contract Language

Sui Uses Move, a Rust-based language originally developed by Meta (Diem). It emphasizes safety and ownership models.

Solana Uses Rust, C, and C++, giving developers familiar language options but with a steeper learning curve.

5. Decentralization

Both are moderately decentralized, but Sui’s validator count (~100) is smaller than Solana’s (~1,000). However, Sui aims for easier validator onboarding in future upgrades.

6. Ecosystem & Adoption

Solana Has a strong foothold in DeFi and NFTs.

Sui Ecosystem is newer but expanding quickly with projects like BlueMove, Cetus, and SuiNS.

7. Security

Sui Object-centric data model isolates transactions, reducing attack vectors.

Solana Though secure overall, has suffered from several network halts in the past.

8. Energy Efficiency

Both are highly energy-efficient thanks to PoS-based consensus mechanisms.

9. Scalability

Sui Architecture allows horizontal scaling — performance improves as network nodes increase.

Solana Focuses on vertical scaling — squeezing maximum performance from each node.

10. Market Metrics (as of Oct 2025)

Sui ~$0.9–1.2 per token, ~$6–8B market cap

Solana ~$231, ~$10–15B market cap

11. NFT & DeFi Support

Solana Dominates NFTs and DeFi volume.

Sui Is catching up with smoother on-chain asset handling and gasless transaction models.

12. Tokenomics

Both are inflationary to reward validators. Solana occasionally burns a fraction of fees, while Sui maintains a fixed staking reward mechanism.

13. Network Reliability

Sui Has shown excellent uptime since launch.

Solana Occasionally faces outages during heavy usage spikes.

14. Future Upgrades

Sui Plans to integrate zero-knowledge proofs and deeper cross-chain interoperability.

Solana Is focusing on stability improvements and validator decentralization.

15. Developer Friendliness

Sui Move language has strong safety guarantees but a smaller developer base.

Solana Has more established tooling but can be complex to optimize for performance.

16. Use Case Fit

Sui Ideal for gaming, NFTs, and instant transactions.

Solana Better for large-scale DeFi, institutional adoption, and existing NFT markets.

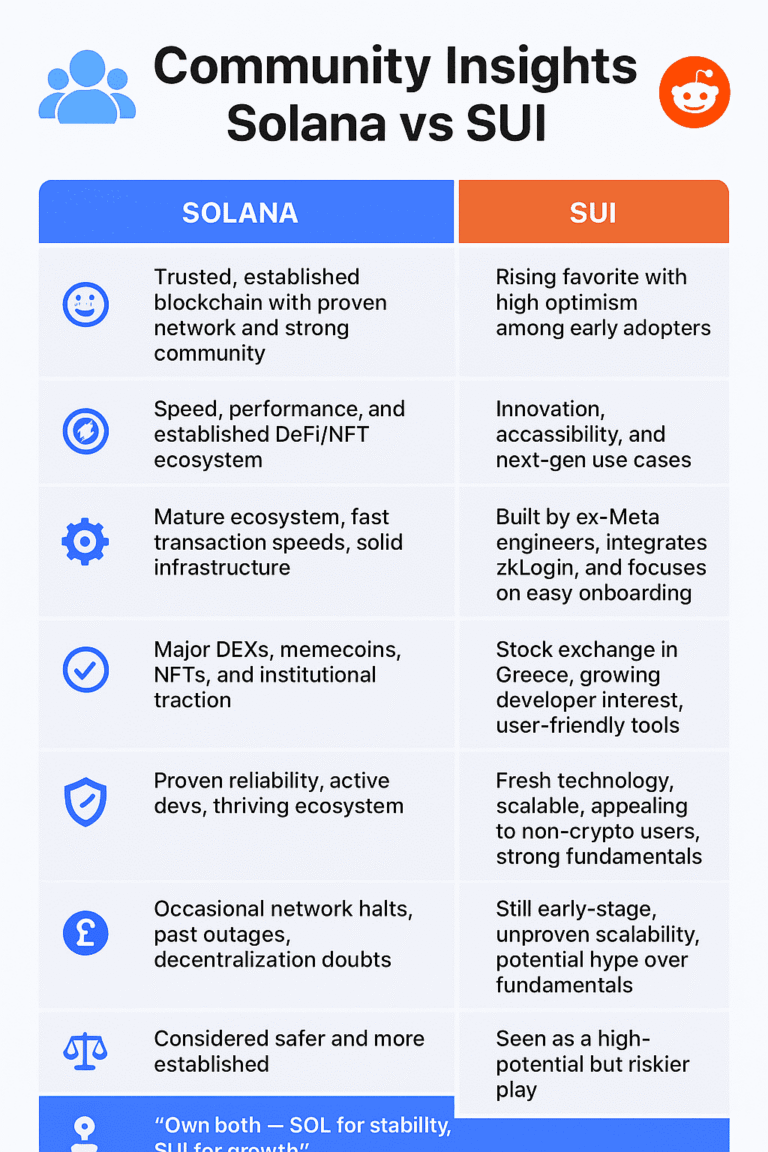

What the Community Says (Solana vs SUI)

In the r/sui thread, users openly compare Solana and SUI, often favoring SUI’s potential, but with some supporters of Solana holding firm. The discussion reveals how sentiment is shifting in some corners of the crypto community.

🚀 SUI Supporters & Optimism

Many users express strong bullish outlooks for SUI:

- One user holds more SUI than Solana, citing adoption signals such as zkLogin, the Greece stock exchange being placed on SUI, and the team’s background (former Meta / Libra). Reddit

- They believe SUI aims for mass adoption even among non-crypto users, especially in gaming and stocks, making the ecosystem more accessible. Reddit

-

“SUI all day … you can invest and sleep on it without waking up to a rug!”Reddit

- Claims that SUI’s API is “sane” over Solana’s, and that Solana’s design imposes limitations in scalability, interoperability, or security. Reddit

🔄 Defending Solana & Mixed Views

While many lean toward SUI, several voices defend Solana’s proven track record:

-

“I’ve looked into SUI … but I’m still more confident in Solana. The dev community is thriving, infra is mature, ecosystem keeps growing.”Reddit

- Some users hedge: they own both coins, citing that Solana has done well historically, while SUI might offer fresh upside. Reddit

- Others question whether SUI can truly overtake Solana, raising concerns about tokenomics, scaling under real load, or whether SUI’s hype may outpace fundamentals. Reddit

⚠️ Key Risks & Reservations

- Central to critics’ arguments against SUI is skepticism over hype: that many claims are speculative, and real adoption (especially outside niche use cases) is yet to be proven.

- Some suggest that while SUI is promising, Solana still has the advantage in ecosystem scale, developer tools, and real-world usage.

- A few caution that switching entirely to SUI may be risky without seeing long-term stability and sustained growth.

Conclusion

Sui and Solana are both fast, low-cost Layer-1 blockchains pushing the boundaries of scalability.

Choose Sui if you value parallel execution, safety, and innovation.

Choose Solana if you want a proven ecosystem with established liquidity and tools.

Both networks are shaping the next era of blockchain usability — one prioritizing speed and innovation, the other scale and adoption.