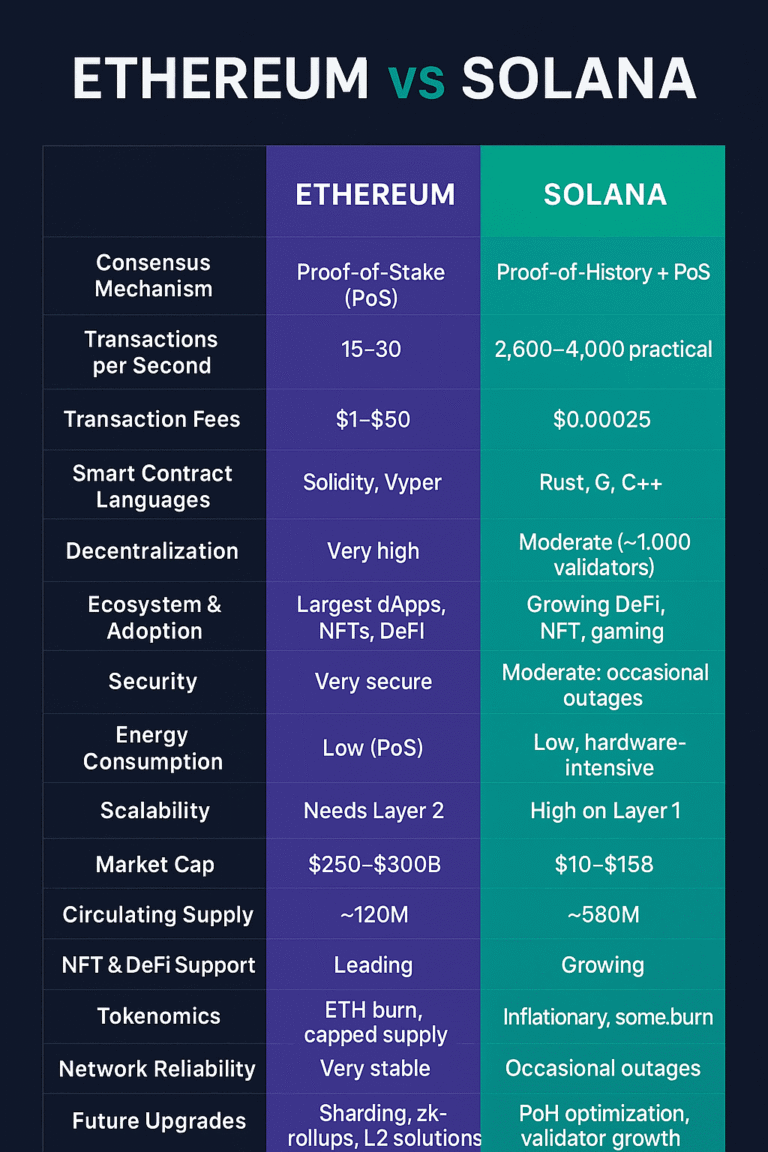

In the ever-evolving world of blockchain and cryptocurrencies, Ethereum (ETH) and Solana (SOL) are two of the most talked-about networks. Both have unique strengths, weaknesses, and use cases, but they operate very differently. This article will compare them across 16 critical parameters to help you understand which one might suit your needs—whether for investing, development, or just curiosity.

| Parameter | Ethereum (ETH) | Solana (SOL) |

|---|---|---|

| Consensus Mechanism | Proof-of-Stake (PoS) | Proof-of-History + PoS |

| Transactions per Second | 15–30 | 2,600–4,000 practical |

| Transaction Fees | $1–$50 | ~$0.00025 |

| Smart Contract Languages | Solidity, Vyper | Rust, C, C++ |

| Decentralization | Very high | Moderate (~1,000 validators) |

| Ecosystem & Adoption | Largest dApps, NFTs, DeFi | Growing DeFi, NFT, gaming |

| Security | Very secure | Moderate; occasional outages |

| Energy Consumption | Low (PoS) | Low, hardware-intensive |

| Scalability | Needs Layer 2 | High on Layer 1 |

| Market Cap | $250–$300B | $10–$15B |

| Circulating Supply | ~120M | ~580M |

| NFT & DeFi Support | Leading | Growing |

| Tokenomics | ETH burn, capped supply | Inflationary, some burn |

| Network Reliability | Very stable | Occasional outages |

| Future Upgrades | Sharding, zk-rollups, L2 solutions | PoH optimization, validator growth |

| Best Use Case | dApps, DeFi, NFTs | Gaming, microtransactions, speed |

1. Consensus Mechanism

Ethereum Uses Proof-of-Stake (PoS) after the Merge. This makes it energy-efficient and more scalable than its original Proof-of-Work system.

Solana Combines Proof-of-History (PoH) with PoS, allowing extremely fast transaction timestamps and higher throughput.

2. Transaction Speed (TPS)

Ethereum 15–30 transactions per second (Layer 1).

Solana Theoretical max ~65,000 TPS; practical speeds around 2,600–4,000 TPS.

3. Transaction Fees

Ethereum $1–$50 per transaction, depending on network congestion.

Solana Around $0.00025 per transaction.

4. Smart Contract Capability

Ethereum Solidity is widely used and well-supported, with an extensive ecosystem of dApps and DeFi protocols.

Solana Uses Rust, C, and C++. Fewer developers currently, but growing rapidly.

5. Decentralization

Ethereum Highly decentralized with thousands of validators worldwide.

Solana Less decentralized, with ~1,000 validators; higher hardware requirements.

6. Ecosystem & Adoption

Ethereum Largest DeFi, NFT, and dApp ecosystem.

Solana Emerging ecosystem in DeFi, NFTs (Magic Eden), and gaming.

7. Security

Ethereum Very secure and battle-tested.

Solana Has experienced network outages under heavy load.

8. Energy Consumption

Ethereum PoS significantly reduces energy usage.

Solana Efficient but hardware-intensive.

9. Programming Languages & Developer Tools

Ethereum Solidity, Vyper; mature tooling like Hardhat and Truffle.

Solana Rust, C, C++; newer ecosystem but improving.

10. Scalability

Ethereum Needs Layer 2 solutions (zk-rollups, Arbitrum, Optimism) to scale efficiently.

Solana Scales efficiently on Layer 1 due to PoH.

11. Market Metrics (October 2025)

Ethereum Price ~$4,520 | Market Cap ~$250–$300B | Circulating Supply ~120M

Solana Price ~$231 | Market Cap ~$10–$15B | Circulating Supply ~580M

12. NFT & DeFi Support

Ethereum Leading NFT marketplaces (OpenSea) and DeFi protocols (Aave, Uniswap).

Solana Growing NFT and DeFi ecosystem; gaming-focused projects are strong.

13. Tokenomics

Ethereum ETH burning reduces supply over time; capped total supply expected in the long term.

Solana Inflationary, with occasional token burns.

14. Network Reliability

Ethereum Very stable; rare network issues.

Solana Network outages have occurred, sometimes lasting hours.

15. Future Upgrades

Ethereum Sharding, Layer 2 adoption, zk-rollups for scalability.

Solana Optimizations to PoH, validator decentralization, enhanced network stability.

16. Use Case Fit

Ethereum Best for complex dApps, DeFi platforms, NFTs, and long-term secure contracts.

Solana Best for high-speed microtransactions, gaming, and real-time applications.

Conclusion

Ethereum is the king of decentralized applications and security, offering a mature and robust ecosystem. Solana, on the other hand, is the speed demon, ideal for microtransactions, gaming, and high-throughput applications.

Your choice depends on your priorities: security and ecosystem vs speed and low cost. Many developers and investors also use both, leveraging each blockchain for its unique strengths.

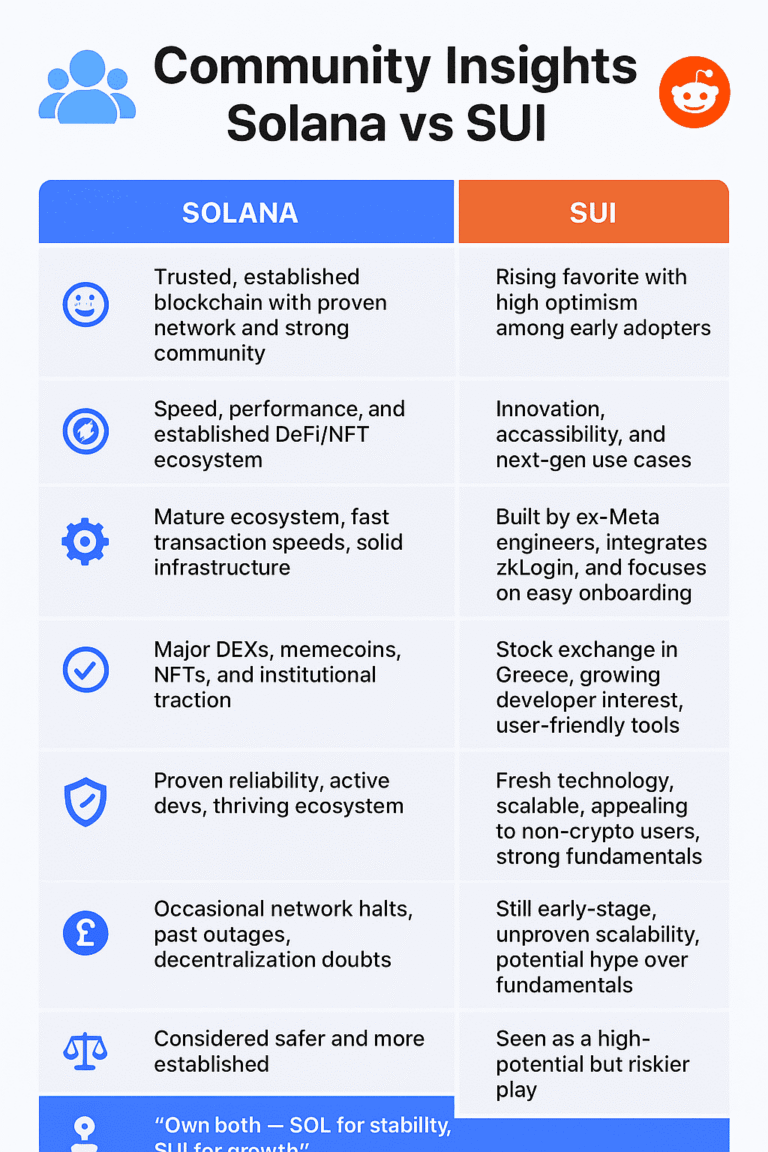

What People Think (Reddit Community Insights)

A recent discussion on r/CryptoMarkets shows that the crypto community remains divided between Ethereum and Solana, each with strong supporters and skeptics.

💎 Ethereum Supporters

Most Reddit users lean toward Ethereum as the safer and more proven option. They highlight its security, decentralization, and mature ecosystem, with one user writing that “ETH is where real innovation and developer activity happen.” Many also view Ethereum as the institutional favorite, backed by major DeFi projects and Layer 2 networks.

Common arguments for ETH include:

- Long-term reliability and network stability

- Higher trust and global adoption

- Strong developer community and established ecosystem

⚡ Solana Advocates

On the other side, Solana fans praise its speed, low fees, and better user experience. They see SOL as the high-upside play—a newer blockchain with room to grow. One comment noted, “ETH is safer, but SOL can move faster and offer more returns if things go right.”

Supporters believe Solana’s improving stability and growing app ecosystem could challenge Ethereum’s dominance, especially in gaming, DeFi, and high-frequency trading apps.

Still, users often acknowledge its network outages and centralization concerns, with some saying Solana works best as a speculative addition rather than a full replacement for Ethereum.

⚖️ Balanced Opinions

Several users took a middle ground, suggesting both coins have a place in a portfolio:

“I keep 70% ETH and 30% SOL. One’s for security, the other for growth.”

Overall, the thread reflects a clear divide — Ethereum represents trust and stability, while Solana symbolizes speed and potential. The community sees both as valuable but suited for different types of investors.