The cryptocurrency world was thrown into chaos recently as over $19 billion in positions were liquidated in just 24 hours, marking one of the most dramatic single-day crashes in recent memory. The trigger? A surprise announcement of 100% tariffs on software imports from China, which spooked global markets and sent crypto traders scrambling.

Major cryptocurrencies took a hit: Bitcoin dropped nearly 8%, while Ethereum slid 12%. For leveraged traders, the fallout was severe — over 1.6 million accounts were liquidated almost instantly, highlighting the risks of high-risk positions in an unpredictable market.

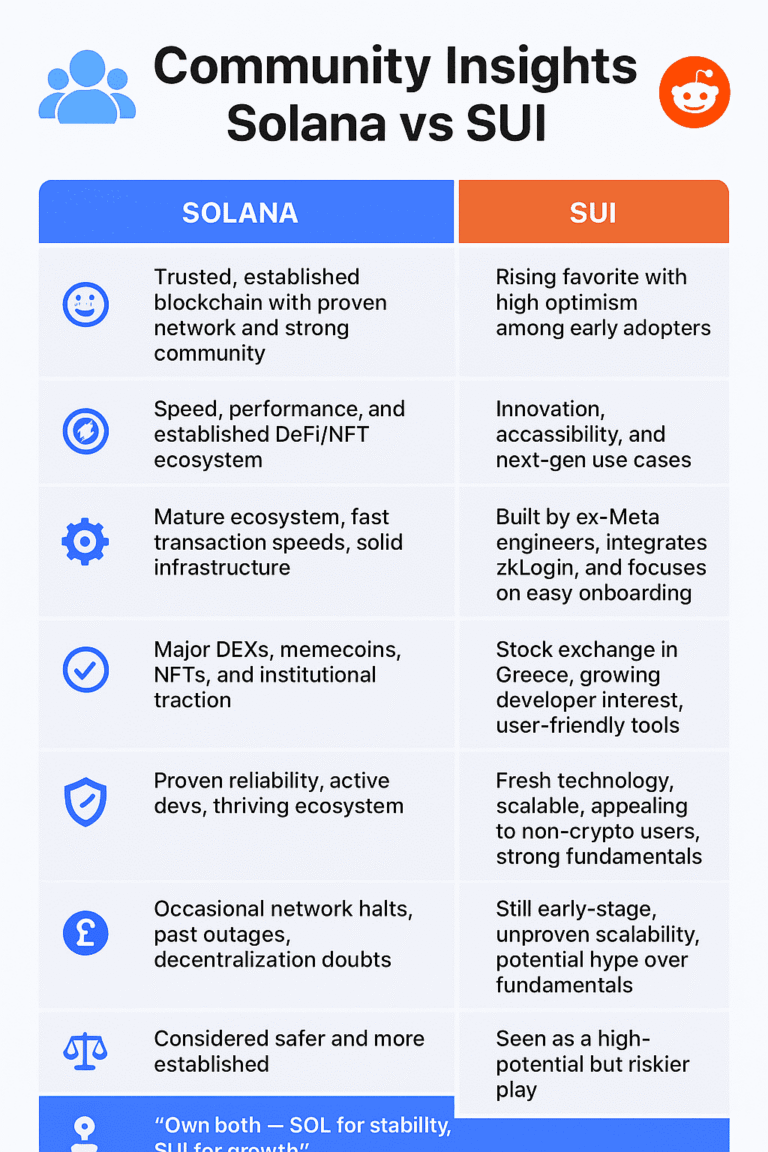

Reddit Reacts: Panic, Humor, and Shock

On Reddit’s r/CryptoCurrency, the community’s reactions ranged from disbelief to dark humor.

“Can’t get much worse,” one user wrote.

“Yeah, wait another 60 minutes,” joked another, referencing the speed at which positions vanished.

The thread captures the chaotic mix of panic and resignation that often accompanies sudden market shocks, showing just how emotionally charged trading can get when millions are on the line.

Why It Happened: Geopolitics Meets Crypto

Experts say the massive liquidation was driven by a perfect storm: high leverage and unexpected geopolitical news. The sudden tariff announcement caught traders off guard, forcing rapid sell-offs and creating cascading liquidations.

Crypto’s volatility is part of its DNA, but events like these remind traders that even small policy changes in global markets can have outsized effects on digital assets.

Lessons for Traders: How to Survive the Chaos

-

Manage Your Risk: Avoid over-leveraging positions, especially during volatile periods.

-

Stay Informed: Monitor news that could affect markets — tariffs, regulations, or major announcements.

-

Use Stop-Losses Wisely: Protect your portfolio from sudden drops.

-

Diversify: Don’t put all your capital in one coin or leveraged position.

-

Keep Calm: Emotional trading often compounds losses; measured decisions save accounts.

Reddit users echoed these lessons in their own ways, sharing strategies for minimizing losses and emphasizing the need to be prepared for the market’s swings.

Looking Forward: Will the Market Recover?

While the crash was dramatic, crypto markets have historically bounced back after large liquidations. Long-term investors may see this as a temporary shake-up, but caution remains essential. Geopolitical tensions and sudden policy moves will continue to influence crypto volatility.

For now, the takeaway is clear: crypto can make fortunes fast, but it can erase them even faster. Traders who stay informed, manage risk, and think strategically are the ones most likely to weather the storm.