Since Bitcoin’s launch in 2009, the crypto world has evolved from a single decentralized currency to a diverse ecosystem of digital assets serving different purposes. Among these, Bitcoin (BTC) and XRP (of the XRP Ledger) stand out as two of the most discussed cryptocurrencies — both designed to revolutionize finance, yet built on fundamentally different principles.

In 2025, as blockchain adoption rises across banking, payments, and investing, comparing XRP vs Bitcoin helps investors and enthusiasts understand which asset aligns best with their goals — speed, decentralization, sustainability, or liquidity.

🧩Quick Comparison Table — XRP vs Bitcoin (2025)

| # | Parameter | Bitcoin (BTC) | XRP (XRP Ledger) |

|---|---|---|---|

| 1 | Launch Year | 2009 | 2012 |

| 2 | Creator / Governance | Anonymous founder (Satoshi Nakamoto); community-driven | Ripple Labs & XRPL community; validator governance |

| 3 | Consensus Mechanism | Proof-of-Work (PoW) | XRP Ledger Consensus Protocol (no mining) |

| 4 | Max Supply | 21 million BTC | 100 billion XRP |

| 5 | Circulating Supply (2025) | ~20 million BTC | ~59.9 billion XRP |

| 6 | Transaction Speed | ~10 minutes/block (finality varies) | 3–5 seconds |

| 7 | Throughput (TPS) | 3–7 TPS (on-chain) | 1,000–1,500 TPS |

| 8 | Average Fee | Variable; can rise during congestion | Extremely low (0.00001 XRP) |

| 9 | Energy Usage | High (PoW mining) | Minimal (energy-efficient consensus) |

| 10 | Primary Use-Case | Store of value, digital gold | Cross-border payments, liquidity bridge |

| 11 | Decentralization Level | Highly decentralized but mining pools dominate | Validator-based; partially centralized perception |

| 12 | Smart Contracts | Limited scripting; via L2 | Token issuance, hooks; evolving smart features |

| 13 | Privacy Level | Pseudonymous | Transparent (public ledger) |

| 14 | Regulatory Status | Treated as commodity (CFTC) | Mixed history; SEC case largely settled in 2023 |

| 15 | Liquidity / Market Reach | Highest in crypto | High but below BTC |

| 16 | Developer Ecosystem | Large global community | Strong Ripple-led & enterprise-focused dev base |

⚙️Detailed Comparison — XRP vs Bitcoin Explained

1. Launch and Origins

Bitcoin emerged in 2009 as the world’s first decentralized digital currency, offering an alternative to traditional fiat systems.

XRP, launched in 2012, was designed for fast, low-cost payments and enterprise-grade cross-border settlements.

2. Governance and Control

Bitcoin has no central authority. Developers propose updates; miners and nodes decide whether to adopt them.

XRP Ledger uses validators, with Ripple Labs playing a major role in governance and escrow control.

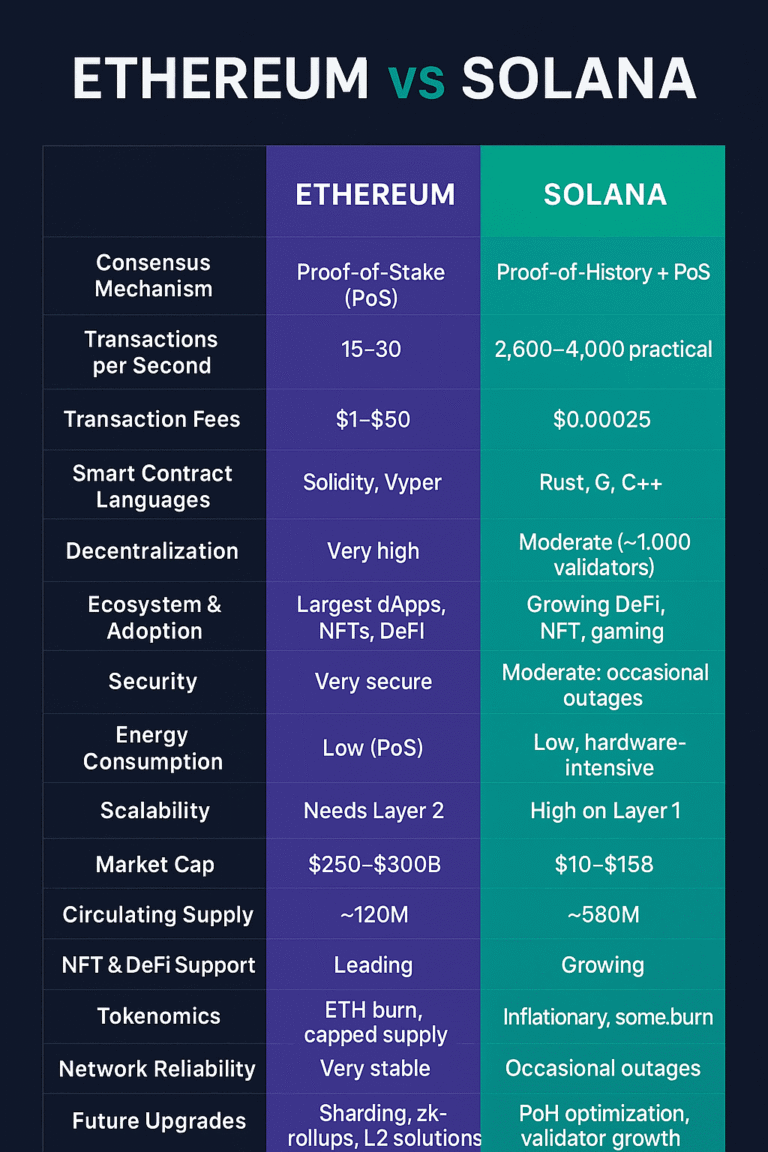

3. Consensus Mechanism

Bitcoin: Proof-of-Work (PoW) — miners solve cryptographic puzzles to secure the network.

XRP: Validator-based consensus that doesn’t require mining, achieving faster settlements.

4. Tokenomics and Supply

BTC: Hard-capped at 21 million, creating digital scarcity — key to its “digital gold” narrative.

XRP: 100 billion tokens created at launch, with Ripple placing 55 billion in escrow to release gradually.

5. Circulating Supply

Bitcoin is nearing full circulation, increasing its scarcity.

XRP’s supply remains high but predictable, ensuring stability in transaction costs.

6. Speed and Settlement

Bitcoin: Transactions take about 10 minutes per block, with multiple confirmations needed for finality.

XRP: Transactions finalize in 3–5 seconds — ideal for real-time payments.

7. Scalability and TPS

Bitcoin: Processes 3–7 transactions per second on-chain; scaling via Lightning Network.

XRP: Handles 1,000+ TPS directly on-chain.

8. Fees

Bitcoin: Network fees fluctuate based on demand; can rise during congestion.

XRP: Fixed micro-fees of ~0.00001 XRP make it one of the cheapest networks.

9. Energy Consumption

Bitcoin: Mining consumes significant power, often compared to small nations.

XRP: Uses a lightweight consensus protocol requiring minimal energy.

10. Use-Case and Purpose

Bitcoin: Functions as a decentralized store of value and inflation hedge.

XRP: Designed for fast cross-border payments and institutional liquidity solutions (RippleNet, ODL).

11. Decentralization

Bitcoin: Thousands of independent nodes globally ensure strong censorship resistance.

XRP: Smaller validator set; Ripple maintains notable influence, though the network is open-source.

12. Smart Contract Capability

Bitcoin: Limited scripting; complex contracts handled via L2 solutions.

XRP: Recently introduced “Hooks” for programmable logic and tokenized assets.

13. Privacy

Both are transparent and pseudonymous — not private by design.

14. Regulation

Bitcoin: Classified as a commodity by the U.S. CFTC — offering regulatory clarity.

XRP: Faced SEC litigation; 2023 ruling clarified public sales of XRP are not securities, improving its status.

15. Liquidity and Market Reach

Bitcoin: Most traded and held crypto asset worldwide; base pair for all exchanges.

XRP: High liquidity, used by financial institutions, but less global dominance.

16. Developer Ecosystem

Bitcoin: Massive open-source community, tools, and institutional adoption.

XRP: Ripple-backed development and enterprise-grade applications.

⚖️Summary: XRP vs Bitcoin — Which One Wins?

Decentralization & Security

Bitcoin

Speed & Scalability

XRP

Transaction Cost

XRP

Energy Efficiency

XRP

Regulatory Clarity

Bitcoin (slightly)

Liquidity & Adoption

Bitcoin

Institutional Use in Payments

XRP

🧠Final Thoughts

Bitcoin remains the most trusted, decentralized, and valuable digital asset — a cornerstone of the crypto market and a hedge against inflation. XRP, on the other hand, delivers real-world payment efficiency that Bitcoin can’t match — offering banks and financial institutions near-instant, low-cost transactions.

In short:

Choose Bitcoin if you value decentralization, scarcity, and long-term investment.

Choose XRP if you prioritize speed, cost-efficiency, and payment innovation.

Both serve different but complementary roles in the evolving world of digital finance.

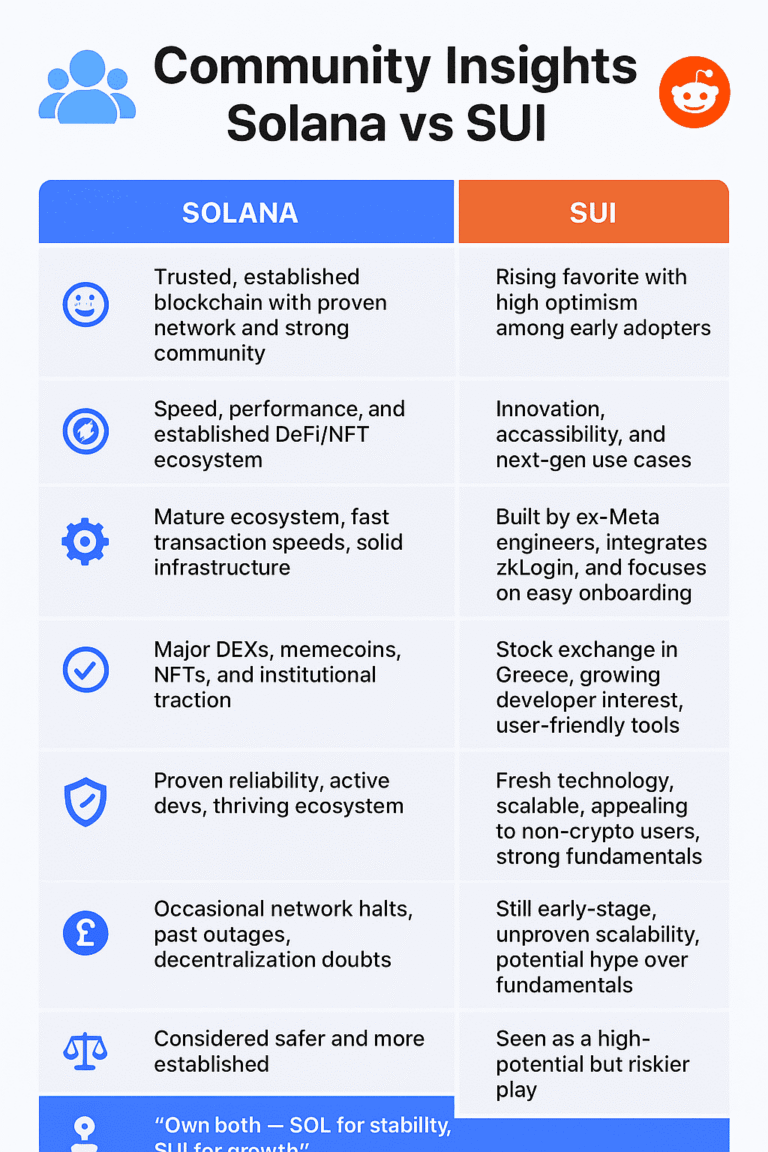

💬What People Think / Community Take

💨 1. Faster and Cheaper Transactions

Many users highlight that XRP is much faster and cheaper than Bitcoin.

- Transactions settle in seconds with minimal fees.

- It’s often seen as a bridge asset that can connect banks and payment systems globally.

🏦 2. Real-World Utility and Banking Potential

XRP supporters argue it’s built for practical payments, not just speculation.

- Ripple’s partnerships with financial institutions make some believe XRP could power future cross-border payments.

- Compared to Bitcoin’s “store of value” role, XRP is seen as more transaction-focused.

⚙️ 3. Bitcoin’s Limitations

Critics of Bitcoin point out issues like:

- Slow transaction speed and high fees during peak times.

- Energy-heavy mining and limited scalability.

- They call Bitcoin a “first-generation” crypto that newer projects like XRP aim to improve upon.

⚠️ 4. Concerns About XRP

Not everyone is convinced. Many remain skeptical because:

- XRP is highly centralized, with Ripple controlling much of the supply.

- Some feel the price is manipulated or overhyped by marketing.

- Transparency and fairness of XRP’s token distribution are often questioned.

🚀 5. Hope, Hype, and Speculation

There’s a clear divide between believers and critics:

- Supporters see massive future potential and price growth.

- Skeptics say most XRP enthusiasm comes from hype, marketing, and unrealistic dreams of getting rich quickly.