As the crypto market matures, investors are beginning to look beyond simple hype and price charts — seeking to understand what truly differentiates major cryptocurrencies. Two such contrasting projects are Shiba Inu (SHIB) and XRP.

While Shiba Inu represents the power of community-driven memecoins evolving into utility ecosystems, XRP stands for institutional-grade payments and real-world financial adoption.

Let’s break down how these two coins stack up on 16 critical parameters — from technology and purpose to community strength and risk.

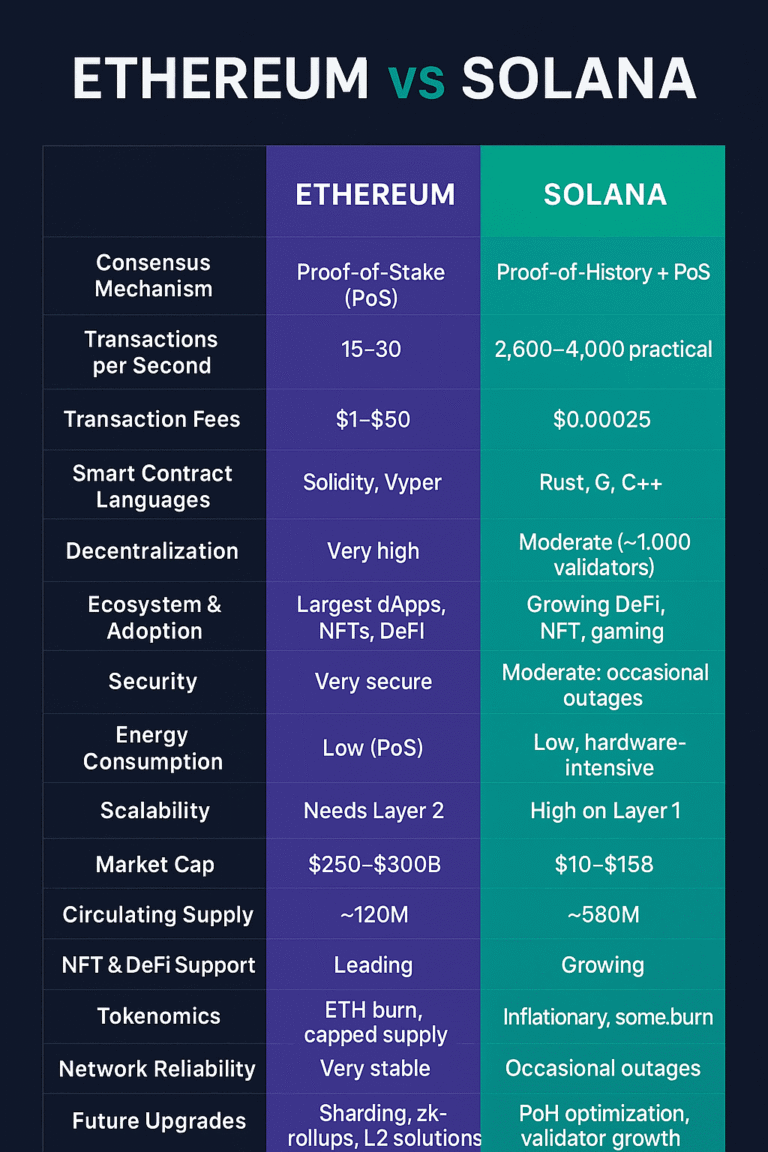

⚖️ Quick Comparison Table

| # | Parameter | Shiba Inu (SHIB) | XRP |

|---|---|---|---|

| 1 | Primary Purpose | Meme token evolving into DeFi, NFT & Layer-2 ecosystem | Global cross-border payments & liquidity bridge for banks |

| 2 | Consensus / Ledger | ERC-20 on Ethereum (PoS) + Shibarium L2 | XRP Ledger (UNL consensus) |

| 3 | Max / Circulating Supply | 589.55T / ~589.25T | 100B / ~59.8B |

| 4 | Market Cap & Rank | Top 20–30 (volatile) | Top 5–10 historically |

| 5 | Transaction Speed | Ethereum L1 ~15–30 TPS; Shibarium faster | ~3–5 sec finality, ~1,500 TPS |

| 6 | Transaction Fees | Variable, lower on L2 | Fraction of a cent |

| 7 | Smart Contract Support | EVM compatible via Shibarium | Limited (basic escrow, payment channels) |

| 8 | Ecosystem & dApps | ShibaSwap, NFTs, Shibarium | RippleNet, On-Demand Liquidity (ODL), XRPL DeFi |

| 9 | Governance | Community-driven (“ShibArmy”) | Ripple Labs-led (escrowed holdings) |

| 10 | Tokenomics | Large supply, deflation via burns | Fixed supply, escrow release system |

| 11 | Liquidity / Listings | Very high retail liquidity | Deep institutional liquidity |

| 12 | Regulatory Outlook | Generally uncontroversial | Major SEC case; now largely resolved |

| 13 | Network Stability | Stable via Ethereum / Shibarium | Highly stable & enterprise-grade |

| 14 | Energy Efficiency | Low (PoS + L2 scaling) | Very low (no PoW) |

| 15 | Community Strength | Massive social media base (“ShibArmy”) | Strong institutional + developer backing |

| 16 | Risk & Volatility | Very high (memecoin dynamics) | Moderate (regulatory + market risk) |

🧩 Detailed Comparison: 16 Key Parameters

1️⃣ Purpose and Vision

Shiba Inu started as a meme token inspired by Dogecoin but now aims to evolve into a multi-utility ecosystem with ShibaSwap (DEX), NFTs, and its own Layer-2 blockchain — Shibarium. XRP, on the other hand, was purpose-built for fast, low-cost international payments — aiming to serve banks, remittance companies, and financial institutions globally.✓ XRP has clearer real-world utility, while SHIB is transforming from meme to ecosystem

2️⃣ Consensus & Network Structure

SHIB runs on Ethereum’s Proof-of-Stake network and extends to Shibarium (Layer-2). XRP Ledger uses its Unique Node List (UNL) consensus, providing rapid confirmations and low energy use.✓ XRP’s native consensus is faster and more scalable for payments; SHIB benefits from Ethereum’s security

3️⃣ Token Supply

SHIB has a massive supply (589T tokens), intentionally designed to allow low per-token prices. XRP has a capped supply of 100B, with about 59B in circulation and the rest in escrow.✓ XRP’s controlled release model is more predictable; SHIB relies on community-driven burns

4️⃣ Market Rank & Cap

SHIB fluctuates heavily with market sentiment. XRP consistently stays among the top cryptocurrencies by market cap due to institutional adoption.✓ XRP holds stronger long-term stability in rankings

5️⃣ Speed & Throughput

SHIB (Ethereum L1) is limited to ~15 TPS but Shibarium dramatically improves this. XRP settles transactions in 3–5 seconds, handling up to 1,500 TPS.✓ XRP is far superior for transaction speed and scalability

6️⃣ Transaction Fees

SHIB: Fees vary with Ethereum gas prices; Shibarium L2 reduces them. XRP: Each transaction costs a fraction of a cent, ideal for micropayments.✓ XRP wins hands down on cost-efficiency

7️⃣ Smart Contracts & Utility

SHIB supports EVM-compatible smart contracts on Shibarium. XRP supports limited programmability, mainly for payment operations.✓ SHIB offers broader programmability; XRP specializes in fast transfers

8️⃣ Ecosystem & Use Cases

SHIB: Ecosystem includes ShibaSwap, NFTs, Shibarium dApps, and community projects. XRP: Ecosystem is financially oriented — RippleNet, ODL, XRPL DeFi.⚖ SHIB is consumer-focused; XRP is institutionally focused

9️⃣ Governance

SHIB: Decentralized in spirit but guided by dev team/community (“ShibArmy”). XRP: Ripple Labs still influences major developments and controls large reserves.⚖ SHIB is more community-led; XRP is more centralized but efficient

🔟 Tokenomics

SHIB: Deflationary approach through manual and on-chain burns. XRP: Transparent escrow system ensures predictable supply release.✓ XRP has structured tokenomics; SHIB’s burn model depends on adoption and hype

1️⃣1️⃣ Liquidity

SHIB: Excellent retail liquidity; popular across exchanges. XRP: Deep liquidity in institutional corridors and exchanges.✓ XRP has more meaningful liquidity for global payments

1️⃣2️⃣ Regulatory Clarity

SHIB: Minimal direct regulatory concern. XRP: Faced an SEC lawsuit (2020–2023); now largely resolved with greater clarity for future use.✓ XRP’s risk has decreased post-settlement; SHIB remains in the “speculative” category

1️⃣3️⃣ Network Reliability

SHIB: Depends on Ethereum’s uptime and Shibarium’s scaling stability. XRP: Highly reliable network with minimal downtime.✓ XRP offers enterprise-grade reliability

1️⃣4️⃣ Energy Efficiency

Both Ethereum PoS and XRP Ledger are eco-friendly, consuming minimal energy compared to Bitcoin or PoW networks.✓ Tie — both are energy-efficient

1️⃣5️⃣ Community Strength

SHIB: Massive online following; social power drives visibility. XRP: Strong professional community — developers, banks, fintech firms.⚖ SHIB wins socially; XRP wins institutionally

1️⃣6️⃣ Risk & Volatility

SHIB: Highly speculative, sensitive to market hype. XRP: Less volatile post-SEC case but still subject to market swings.⚖ SHIB = high-risk/high-reward; XRP = lower-risk/steady growth

🧠 Final Verdict: Which One to Choose?

| If you want… | Pick This |

| Community-driven, high-upside speculation | 🐕 Shiba Inu (SHIB) |

| Practical utility, fast transactions, and enterprise backing | 💧 XRP |

Both have their niches — SHIB thrives on culture, while XRP thrives on credibility. Choosing between them depends on your investment goals: speculative upside vs real-world adoption.

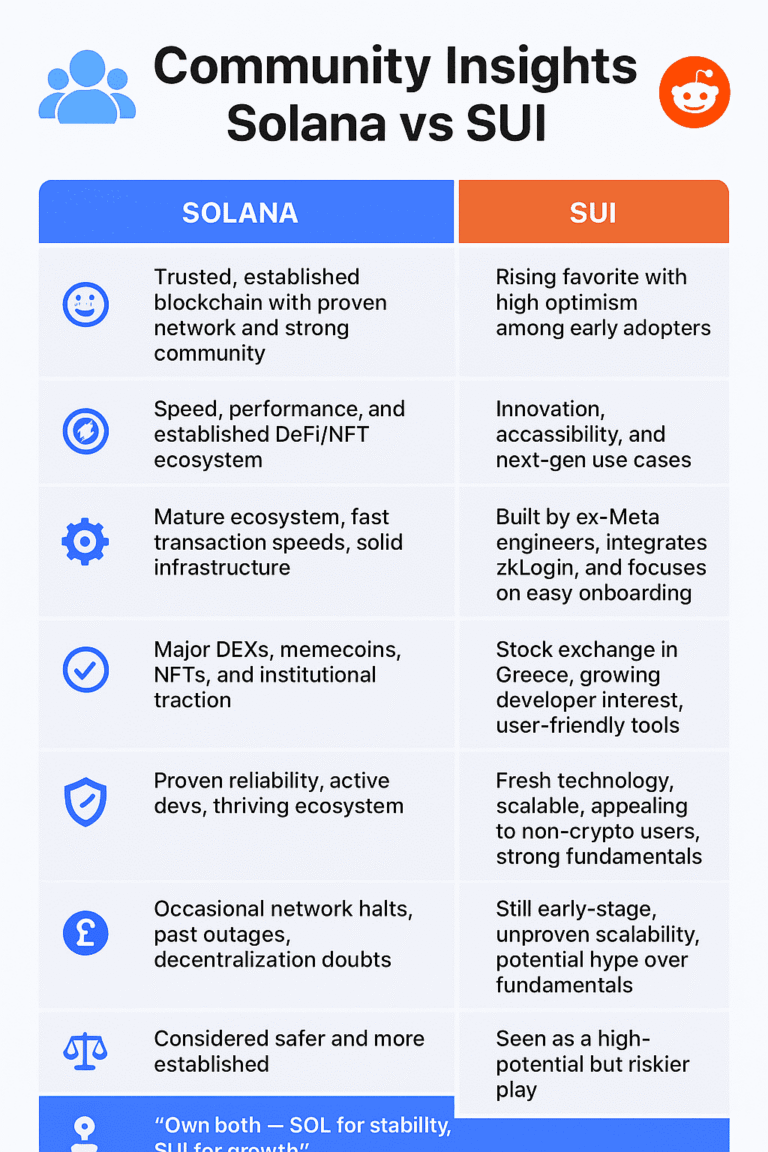

💬 What the Community Says

Here’s how the crypto community — especially on Reddit — feels about selling Shiba Inu for XRP:🐶Shiba Inu — “The Meme with Momentum”

- Many users admit Shiba Inu is mostly hype-driven, thriving on community energy, memes, and quick gains.

- It’s seen as a high-risk, high-reward coin — great for short-term speculation but lacking strong fundamentals.

- Some holders believe SHIB still has potential through Shibarium (its layer-2 project) and community growth, but most agree it’s volatile and unpredictable.

💧XRP — “The Utility Bet”

- Supporters describe XRP as more serious and utility-focused, tied to real-world use in cross-border payments and banking systems.

- Many commenters argue that XRP has long-term potential once regulatory clarity and broader adoption come through.

- However, some warn it’s not guaranteed success — the SEC lawsuit and slow institutional rollout make people cautious.

⚖️The Community Verdict

- Most people advise not to go “all in” on either — suggesting diversification between meme coins and utility-based projects.

- The general tone on Reddit is balanced:

- “SHIB is fun, but risky.”

- “XRP could win big, but patience is key.”

- Overall, traders see it as a choice between short-term hype (SHIB) and long-term belief (XRP) — depending on your risk appetite.